The bear market is coming – at some point. Of course! History shows that there will be a bearish market sometime in the future; the problem is that no one really knows when we’ll reach the top of the market, right before the bear bares his claws.

That said, I personally believe that there’s a good chance that this bull market is close to its end. It’s apparently the second-longest in history, having lasted about nine years. That makes me a bit cautious, and has led me to make some defensive plays, in case the top of the market is imminent. I’ve constructed a defensive portfolio which I think will reduce my losses when the bear market finally comes (whenever that may be). So, today, I want to share that with you.

What This Is, and What It’s Not

This is my personal opinion, and not financial advice. I’m not a financial professional – just someone who likes to follow the markets and actively control part of his portfolio. And by “part”, I mean exactly that – a part, less than half. The majority of our portfolio is safely tucked away in tax-advantaged retirement accounts, invested in broad-market index funds. We don’t even look at it; we just keep putting in part of every paycheck, automatically.

I strongly believe that trying to time the market is a bad idea for long-term retirement accounts. For short and medium-term accounts, however, I give myself a bit more latitude to shake things up, both because I enjoy it and because I want to become a better investor and trader. So, I readjust our investments every few months in these accounts, based on what I think the markets may bring. I may not be looking at great odds and I’m no Bobby Axelrod, but I still choose to play the game.

This is the story of our main non-retirement account and what I’ve invested in, in preparation for what I believe to be the upcoming bear market. It’s what I think are the best stocks to buy now, as well as bonds and ETFs. So here it goes!

My Broad Objectives for a Bearish Market

My three main objectives are to (1) make money as long as the bull market lasts, (2) reduce losses when the market is declining, and (3) make income. I do not intend to make money in terms of capital appreciation during a bear market, because that is, by definition, next to impossible if you’re buying a big basket of stocks. You can definitely make money during a bear market, but it would essentially require very risky strategies, such as (A) making big bets on individual stocks, or (B) going short (by methods such as short selling, or using options or inverse funds). That’s not my strategy here, because I’m not willing to take big losses on this account.

With that in mind, and as you’ll see, I think the best stocks to invest in right now mainly concern broad sector plays. Additionally, I’m reducing risk and volatility with big loan-based holdings.

The bear that doesn’t scare

My Bear Market Portfolio

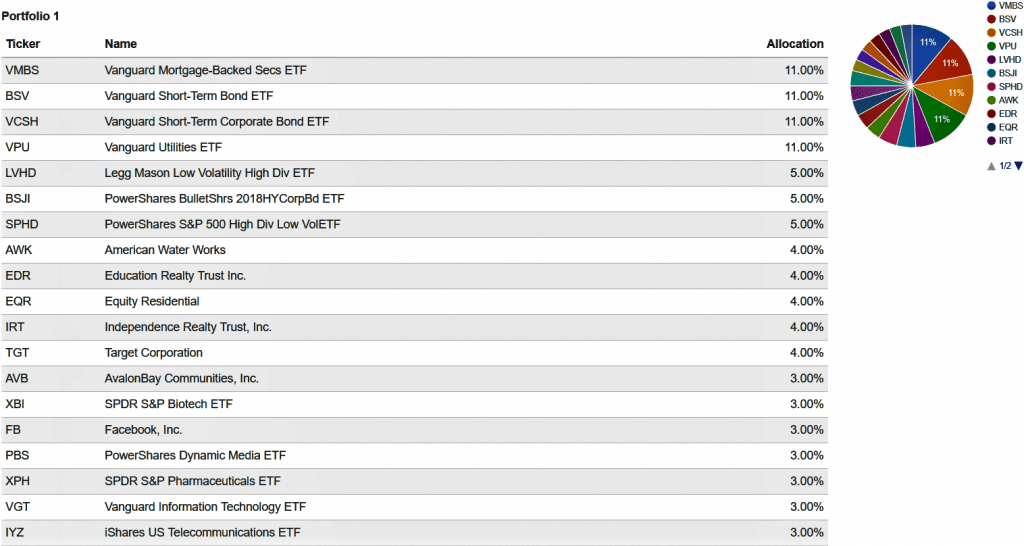

Without further ado, here’s my portfolio for the upcoming bearish market, in order of holding size. The holdings are not an exact match to what I’ve bought, because I use some proprietary sector-based portfolios from my broker, but I’ve listed very similar securities where necessary.

So first, here’s a pretty list I made at Portfolio Visualizer. Then, I’ve prepared an explanation of each holding:

First Holdings – Loan-Based Securities (38%)

To produce income and reduce risk and volatility, I own four loan-based funds, making up a total of 38% of the portfolio.

The first is Vanguard Mortgage-Backed Securities ETF (VMBS) (11% of the total portfolio). Frankly, I got this because it’s included in one of my broker’s income-producing portfolios. It’s got a decent yield of 2.34%, and is invested in mortgage-backed securities. I’m comfortable with it because it’s based on secured loans, for which the standards have gotten much tighter since the 2008 financial crisis.

Second is Vanguard Short-Term Bond ETF (BSV), at 11%. It’s a safety play because it’s mainly invested in government bonds, and yields an acceptable 1.73%. I like that it’s in short-term bonds, which should provide some protection against rising interest rates.

The third is Vanguard Short-Term Corporate Bond ETF (VCSH), at 11%. Same thing, but with corporate bonds. The yield is better, at 2.31%.

Lastly, there’s PowerShares BulletShares 2018 High Yield Corporate Bond ETF (BSJI), at 5%. This is a junk-bond, bond ladder ETF, which owns a series of high-interest, high-risk corporate bonds set to mature later this year. At maturity, the fund dissolves itself and returns the principal to shareholders. Theoretically, it should mitigate interest-rate risk. It yields 3.55%.

Second Holdings – Residential Real Estate (15%)

Because everyone’s got to live somewhere, even during a bearish market. Also, yields are pretty sweet. Here, I’ve got four holdings (for the sake of diversification), making up 15% of the portfolio.

The first is Education Realty Trust, Inc. (EDR), at 4%. It’s a REIT involved in housing for college students, and yields 4.64%. I like this one, because people will always go to college, until we discover how to directly download information into our brains.

Second is Equity Residential (EQR), at 4%. They own and manage rental apartments “…in urban and high-density suburban coastal gateway markets where today’s renters want to live, work and play“. I actually lived in an Equity property, and it was nice and well-managed. Plus, it yields 3.53%.

Third is Independence Realty Trust, Inc. (IRT), at 4%. It’s a REIT that owns and administrates multifamily apartment properties, and yields 7.74%

Finally, there’s AvalonBay Communities, Inc. (AVB), at 3%. They’re also a REIT involved in the apartment game, and yield 3.53%.

Third Holdings – Utilities (14%)

Like with residential real estate, because everybody needs ’em. So, I think they may be some of the best stocks to invest in right now.

First, I’ve got Vanguard Utilities ETF (VPU), at 10%. It yields 3.15%, and the top holding is NextEra Energy, Inc.

Second, I own American Water Works Company, Inc. (AWK), at 4%. It “…provides water and wastewater services in the United States and Canada“. Since you can’t live without water, it may be one of the best stocks to buy now, in my view. The yield is 2.12%.

Fourth Holdings – Low Volatility, High Dividend Funds (10%)

For 10% of the portfolio, I’ve got two funds that are supposed to offer what their name says: low volatility and high dividends, perhaps representing some of the best stocks to buy now, if a bear market is indeed close. The only reason I’ve got two is to provide some diversification.

The first is Legg Mason Low Volatility High Div ETF (LVHD), at 5%. It yields 3.54%, and “…seeks to track the investment results of an underlying index composed of equity securities of U.S. companies with relatively high yield and low price and earnings volatility”. You can see what that means here.

My second holding is PowerShares S&P 500 High Dividend Low Volatility ETF (SPHD), at 5%. It tracks what seems to be a somewhat similar index, and yields 3.56%. Details here.

Fifth Holding – Target Corporation (TGT) (4%)

Yup, the store chain. I bought it because my wife Lily says it’s got good prospects, and I believe she knows what she’s talking about. It yields 3.45%.

Sixth Holdings – Biotech (3%)

Because we all need medical care, especially in a world with an ever-expanding population.

The sole holding here is SPDR S&P Biotech ETF (XBI), at 3%. It yields 0.28%.

Seventh Holding – Facebook (3%)

Not really a play on Facebook itself, but rather on its Whatsapp and Instagram properties. Instagram is supposedly hot among people more visually oriented than I am. I actually use Whatsapp often, and love its cross-platform compatibility. I can communicate with someone who has an Android phone (I’m an iPhone guy) without a hitch.

If you think Whatsapp, Instagram, or Facebook itself have a bright future, then this might be one of the best stocks to invest in right now.

It yields nothing (apparently, doesn’t pay dividends).

Eight Holdings – Media (3%)

Because, good or bad economy or stock market, people like to be entertained. I’m especially keen on companies that deliver entertainment to the home, for those “Netflix and chill” nights. I don’t see how this sector would fail to grow in the long term.

The sole holding here is PowerShares Dynamic Media ETF (PBS), at 3%. Its biggest holding is Netflix, and it yields 0.42%.

Ninth Holdings – Pharmaceuticals (3%)

Again, because people need medicine, no matter what.

The sole play here is SPDR S&P Pharmaceuticals ETF (XPH), at 3%. It yields 0.71%.

Tenth Holdings – Tech (3%)

Because the world is becoming more connected. More smartphones, more technology. I don’t see any reversal of this trend anytime soon.

The sole holding here is Vanguard Information Technology ETF (VGT), at 3%. It yields 0.96%.

Eleventh Holdings – Telecom (3%)

Because these are the companies that deliver the tech and media industries’ products to people.

A good holding might be iShares US Telecommunications ETF (IYZ), at 3% (I own one of my broker’s proprietary portfolios). IYZ yields 3.59%.

A Total Portfolio for a Bearish Market

That’s my complete bear market portfolio. I think it represents a good defensive play if we’re at or near the top of the market, and may contain some great stocks to buy now.

Back-Testing the Bear Market Portfolio

Anyone can talk, including me. Let’s take it further, and back-test this against an S&P 500 ETF (SPY) using Portfolio Visualizer’s back-testing tool.

(The setting are (1) dividend reinvestment, (2) a hypothetical $10,000 investment, and (3) monthly re-balancing).

Scenario One – A Bull Market (1/1/2017 to 12/31/2017)

Bear Market Portfolio Ending Balance: $10,879

SPY Ending Balance: $12,170

SPY wins, easily. Considering that the bear market portfolio is 38% based on loan securities, I’m not surprised.

Scenario Two – A Falling Market (2/1/2018 to 4/30/2018)

Bear Market Portfolio Ending Balance: $9,869

SPY Ending Balance: $9,421

The Bear Market Portfolio wins, as expected. It only fell around 1.31%, while the S&P 500 (as represented by SPY) fell about 5.79%. So, the downside protection was about 4.48%. Put another way, the SPY fell about 4.4 times as much.

Scenario Three – A Slightly Falling Market (1/1/2018 to 4/30/2018)

Bear Market Portfolio Ending Balance: $9,865

SPY Ending Balance: $9,952

SPY wins. It fell about 0.48%, while the Bear Market Portfolio fell around 1.35%.

Back-Test Results

As I interpret these results, the Bear Market Portfolio does, indeed, minimize losses, but only when there’s a significant decline in the markets. It does what it’s meant to do – offer protection against substantial declines, though not really against small declines. Income is also pretty good – 2.75% as back-tested to 2017 (with dividends reinvested) or 2.72% (without dividend reinvestment).

In a bull market, it should gain value, but less than a stock-only, broad-based market fund like SPY.

Summing It Up

Since I think there’s a solid chance we’re near a top of the market, I believe that this portfolio includes some of the best stocks to invest in right now, plus good debt securities. I expect it to greatly reduce the losses of a broad, all-stock portfolio when there’s a bear market, though it’ll also reduce gains during a bull market.

It’s also a flexible portfolio. If you agree with me in terms of thinking there’s an approaching bearish market and want to adopt this portfolio, you can definitely play around with the holdings, and modify as you wish. Since most of such holdings are sector-based, there’s plenty of room for modification.

And again, I think this suits my short and medium term accounts, since the market can take years to recover from a bear market (historically, it can be over 25 years, depending on how you run the numbers). Still, for retirement accounts where I won’t need the money for decades, I think funds like SPY are a better option. So, the Bear Market Portfolio is just that – a portfolio to reduce losses during a bear market.

Do you think we’ve seen (or are about to see) the top of the market? Are you taking any defensive steps?

Well thought out and presented Miguel. Having a plan and sticking to it is the best way to go. We are positioned pretty conservatively as well. Partly because of the inevitable downturn you discuss but also because of our stage in life. Losses hurt a lot more than lost upside potential to us. Tom

Thanks Tom,

Yeah, at this point I don’t have enough faith in the longevity of the bull market to be too heavily into equities in non-retirement accounts. We don’t want to risk big losses in our “extended emergency fund”, if we can’t be sure we won’t need the money for many years.

Cheers,

Miguel

It looks like you got it figured out which is the biggest step. I see a bearish market as an advantage to continue funding my retirement and buying more for my buck. I have many years until retirement so a down market could be advantageous. But we’ll see how my stress level takes it. 🙂

Thanks SMM,

I agree in terms of retirement accounts. There, we’ll just keep buying stocks with every paycheck. But like you say, the stress levels definitely rise when a bear market starts, even if the losses are “just on paper”.

Cheers,

Miguel

Nice portfolio. But, its too complex man! To create and maintain this portfolio would be cumbersome. Could you look at correlation to see if you remove certain positions? Your time frame is too small. How about back testing this portfolio between 2008-9?

Hey DG,

Thanks for the feedback 🙂 As to your points:

-On my broker (M1), it’s easier to maintain, since you form a “pie” with the securities (and don’t pay commissions). Once it’s done, you just add money to it; they take care of all transactions and re-balancing.

-I’m not at the level of looking at correlation yet. For better or worse, my approach to investing is not that quantitative, especially with this account.

-You’re right about back-testing, but I can’t fully do it because some of the securities did not exist (or were not publicly-traded) in 2008-2009.

Cheers,

Miguel

Very impressive, Miguel. Thanks for sharing. I’m taking a different approach. I’m sticking with broad-based index funds, but I’m protecting my portfolio from the upcoming correction with a large dose of bonds and cash. We’re following the Pfau-Kitces glide-path strategy in which retirees enter retirement with a low stock allocation and gradually increase that allocation over the years until a 50/50 or 60/40 allocation is achieved. Right now I’m in the second year of retirement. My allocation is 40% stocks and 60% bonds/cash. I increase my stock allocation 2.5% every year. Anyway, that’s the game plan. Avoid a bear market early in your retirement by having a relatively low stock allocation. It seems to be working so far. We’ll see what happens when the next big one comes. Cheers, my friend.