As a crypto enthusiast, I’ve lately been looking for more security, especially in my DeFi endeavors – and that’s when I happened upon crypto insurance. I’ve been doing a lot of research on the options available to consumers, and I’m ready to talk about the two that I’ve focused on: Nexo Mutual and InsurAce. Here’s why I prefer InsurAce.

Why I Will Insure my DeFi Investments with InsurAce

Note: This post contains my InsurAce referral link, which may reward me if you click on it and use InsurAce. Also, this is all my personal opinion and not professional advice. All materials were accessed on 9/25/2021. I recommend you confirm that this is all still valid before making any decisions.

Crypto Insurance is Not Real Insurance

First of all, let’s note that this is not strictly insurance. It’s more of an insurance-type cooperative where members invest and pay out claims at their discretion. If I could buy traditional insurance for my DeFi investments, I definitely would. I am turning to this “crypto insurance” because there’s really no other choice right now.

Why I Prefer InsurAce Where It’s Available

InsurAce has Stronger Coverage Language

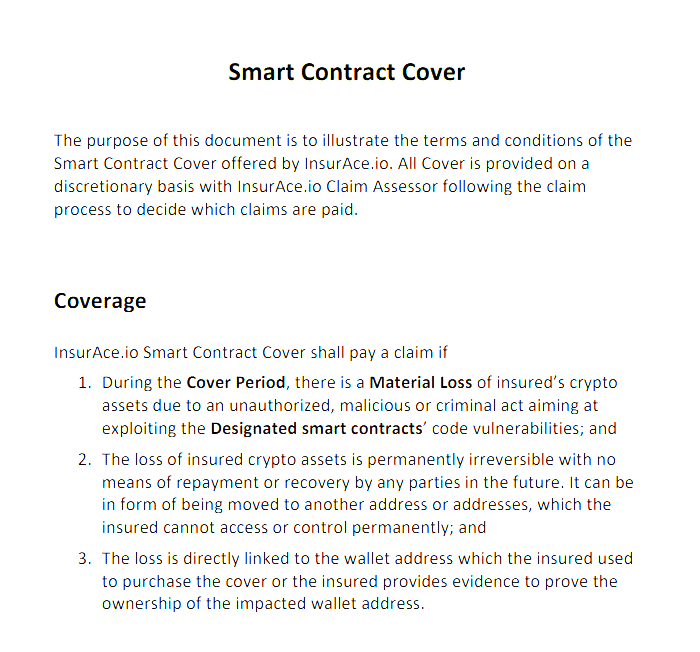

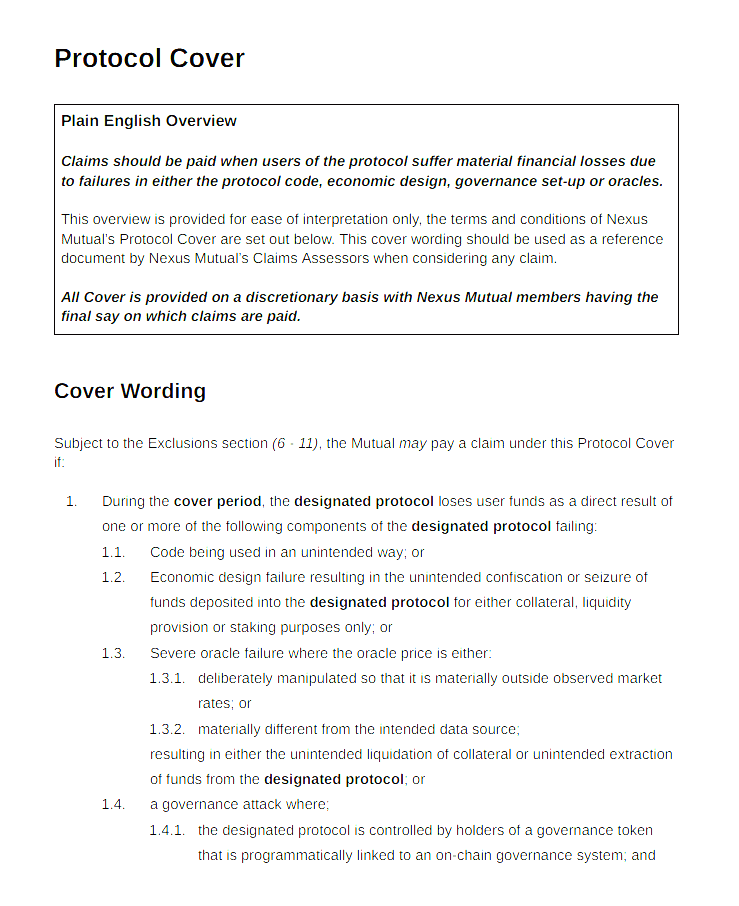

Specifically, I want to insure my liquidity pool investments in SushiSwap. So, I first looked at the coverage language on both. It’s similar, but I like that InsurAce has stronger language, saying that it “shall” pay claims, rather than Nexus’s “may”. They are both subject to member votes and others measures where a claim can still be declined, but I prefer InsurAce’s stronger language. Here it is, as of 9/25/2021:

InsurAce:

Nexus Mutual:

The InsurAce Claims Process Seems Better and Safer

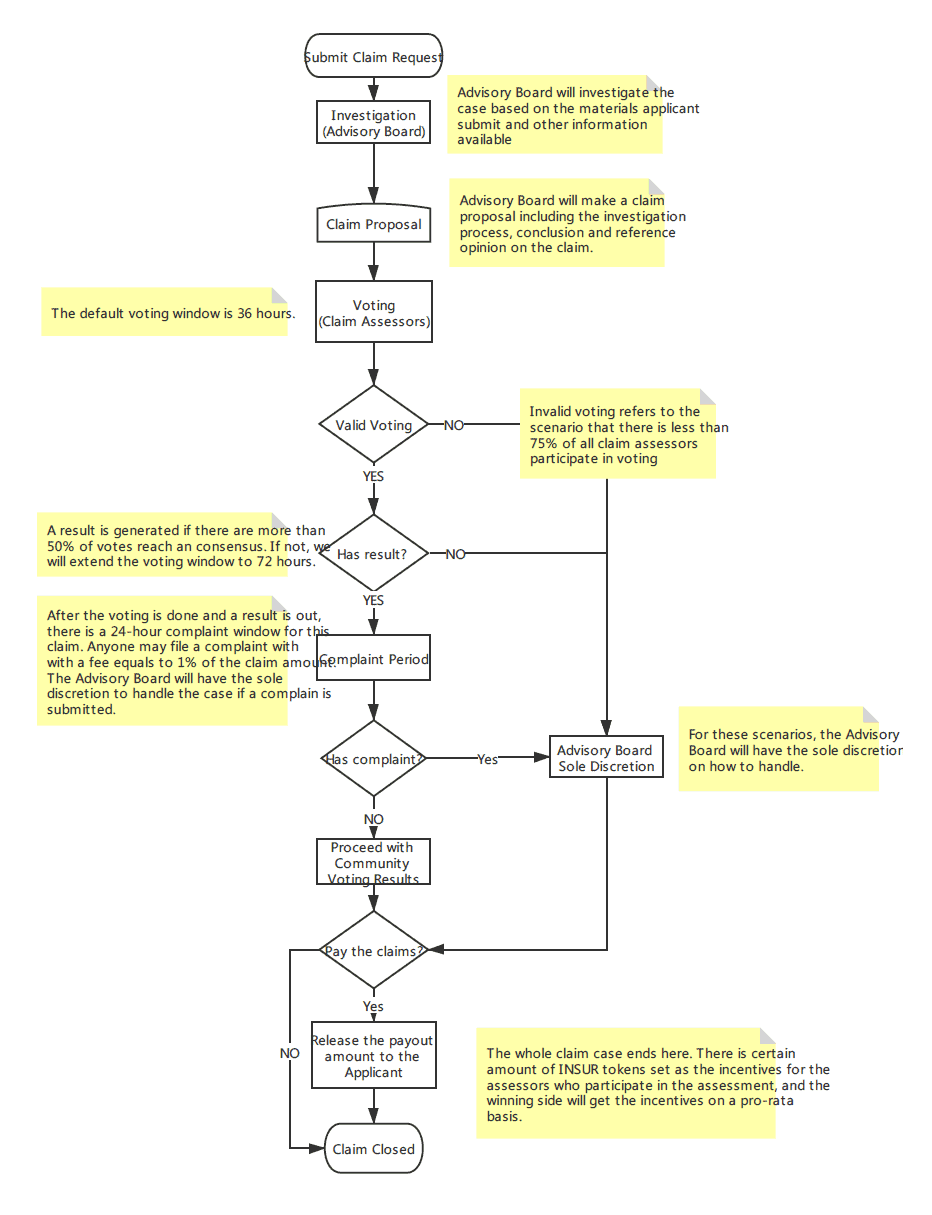

Second, I must say that the crypto insurance claims process from InsurAce is much more to my liking, mainly because InsurAce prepares a report for every claim. In more detail, the Advisory Board (currently comprised of four persons) prepares a Claim Reference Report investigating the claim. As far as I know, Nexo does not do this.

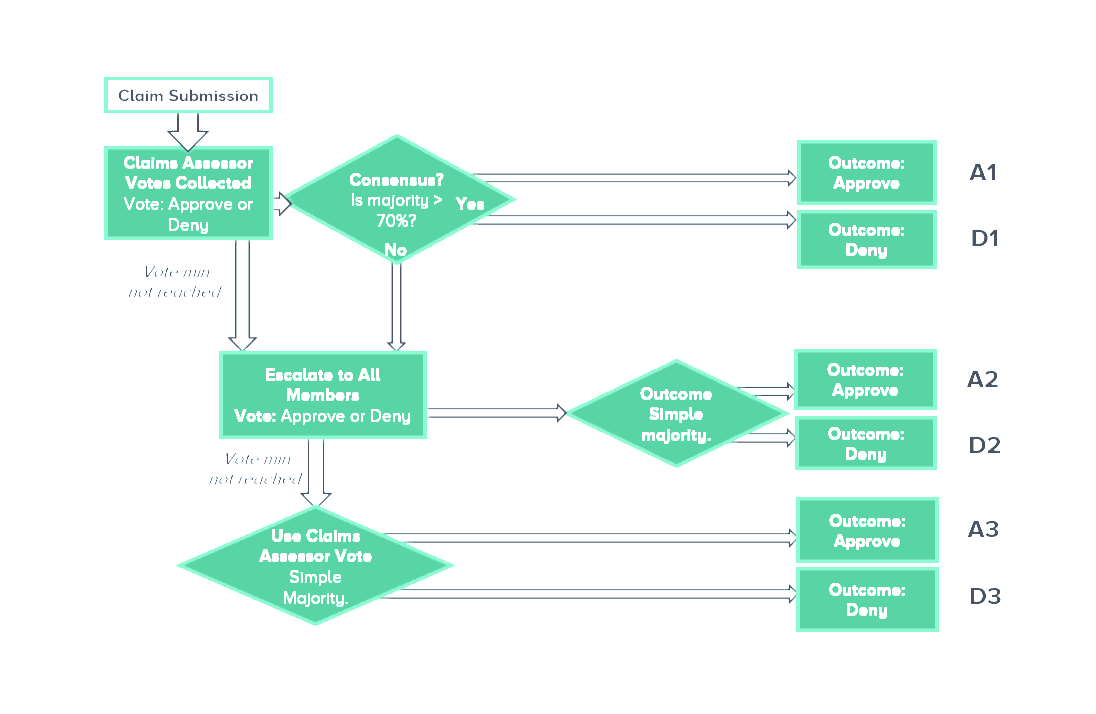

In terms of the rest of the claims assessment process, they are similar, though InsurAce has, in my opinion, and important additional safeguard. You see, with Nexo’s model, community votes are final. However, with InsurAce, the community vote prevails unless a complaint is lodged. In that case, the Advisory Board decides.

So, the way I see it, InsurAce crypto insurance is better because you get both a report evaluating the merits of your claim, and an appeal to a Board with publicly-known members. I prefer this to Nexo’s lack of a report and then anonymous and final voting. I don’t like the idea of paying a premium only to have my claim potentially denied by an anonymous pool of assessors, with no explanation or means of recourse.

This is the Nexo process:

And here is InsurAce’s process:

Of course, since anyone can file a complaint (with a fee payment), you may actually prefer Nexo’s model where an Advisory Board cannot overturn the voter’s will. That’s a matter of preference; I prefer the InsurAce process because I’m betting that random people won’t file complaints since they have to pay the fee. So, to me it’s more of an appeals process for denied claims.

Also, you may dislike that the Advisory Board’s initial report may be extremely influential on the member vote. It could work to your advantage or your detriment, depending on what the report says.

Remember that this is Crypto Insurance, Not Traditional Insurance

Crypto insurance is not traditional insurance, which I would greatly prefer. Rather, it’s like a catastrophe cooperative that might pay you if you lose your money in a crypto project. Also, there are no financial stability ratings like there are with traditional insurance, so it’s perhaps harder to make sure companies like InsurAce and Nexus have the means to pay out all legitimate claims.

Still, it’s what we have, and DeFi can be extremely profitable. So, I plan to give it a shot.

Leave a Reply