I’ve been writing about cryptocurrencies for a while, and something I’ve been asked often is why anybody would actually need them. After all, who needs Bitcoin or other digital currencies when they have dollars, euros, or yen? And it’s a fair question: why would I go through the hassle of paying for my coffee in Bitcoin if I can just swipe my credit card?

Well, the short answer, at least for the time being, is that there’s no reason to use cryptocoins to make payments, in most circumstances. To me, that’s not what digital currency is about right now, and is not the reason I’ve invested in several cryptocurrencies (mainly Ether, but also IOTA and others). Rather, there are other, more important, so-called “use cases” for these digital coins. This is where I see a lot of the promise, and why I keep buying digital currency every month. Let’s see what they are.

Three World-Changing Use Cases for Digital Currency

1. As A Substitute for Money in Countries With Useless or Controlled Currencies

For those of us fortunate to live in First World counties, the value and usability of national currencies is not really an issue. I live in the US, and can count on dollars every day. I know that they’ll hold their value and that inflation is low enough that $100 today will buy more or less the same goods and services as $100 a month from now.

But what about the millions upon millions of people that live in places like Venezuela, where, as of August 2018, inflation was running at about 1,000,000% per year? That’s right – one million percent. Per Forbes, that means that “…the price of a cup of coffee doubles between your weekly paychecks”. Imagine that – if a latte cost $5 today but $10 in a week.

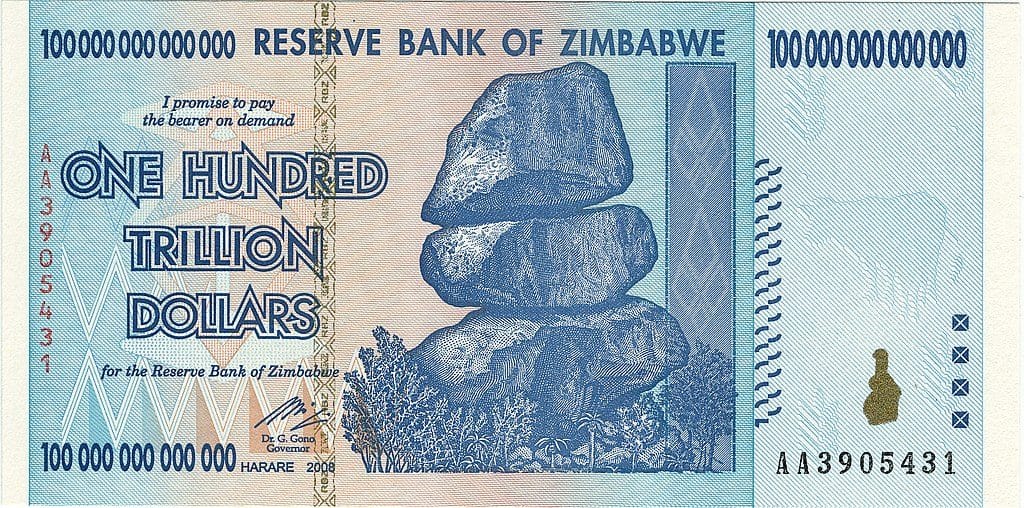

Or what about perhaps the biggest hyperinflation basket case ever: Zimbabwe? There, “[the] annual inflation rate peaked in November 2008, reaching 89.7 sextillion (10^21) percent“. Check out this banknote:

A hundred trillion dollars, anyone?

Or how about this Yugoslavian banknote:

I’m not even going to try to understand that number!

Currency Controls

But what if the problem in your country isn’t hyperinflation, but currency controls? In early 2002, Argentina imposed strict measures restricting its own citizens’ access to their hard-earned money, with bank closures and controls including one where “…all money in current accounts above $10,000 (£7,000) and savings accounts above $3,000 will become fixed-term deposits, untouchable for a year” (The Guardian). Even today, it’s pretty hard to move your money into and out of China, which has a relatively stable currency.

The Promise of Crypto Coins

Considering situations like these, the potentially enormous value of a cryptocoin comes into focus. To hold many digital currencies, all you really need is a digital wallet (which you can oftentimes create freely and anonymously) and your key (password). You can access your money from anywhere with an internet connection, thereby bypassing any capital controls on the national currency (if legal to do in your country), and be relatively protected from worthless or unstable currencies.

Believe me, if I were in a country with an unstable currency right now, I’d rather put my long-term savings in a digital coin, instead of the national currency.

A bank run. (Credit: Lee Jordan, Man vyi [Flickr])

2. For Smart Contracts

To borrow from YouTube personality Ameer Rosic, imagine that you want to buy a used car from someone else. Today, you’ll probably have to go through a multi-step hassle, including going to your bank to get a certified check for the purchase price, and then going to the DMV to transfer the title to you after you’ve paid the owner. To buy a house, the process is even more complicated, involving escrow and the recording of ownership.

With smart contracts (enabled by several digital currencies such as Ether), it’s all streamlined and virtually instantaneous. If I want to sell my car, I’ll put all the title and ownership information on the blockchain. Once the buyer and I agree on the price, he’ll simply pay me with digital coins, and the title will be automatically transferred to him. No trips to the DMV or other bureaucratic hassles. In essence, a computer program will issue an output (transfer of title), upon getting an input (receipt of funds).

Another example could be if you sell something online. With smart contracts, you might not need a payment processor. All you need is a smart contract that automatically triggers delivery of your goods when you receive payment, speeding things up and cutting out the middleman and his fees.

If you like learning from videos, check out Amir’s on smart contracts:

A final example that shows the potential of this technology would be property rental, as the next video discusses. For instance, you could rent out a property online with an internet-connected lock. Once a renter paid, a smart contract could make the lock open via an app on the renter’s phone.

All of this would take place automatically, without your input. The same could apply to a fleet of rental cars. A series of inputs (verified driver’s license information, payment, etc.) would cause a series of outputs (the lock on the car opening for the renter).

3. For Machines to Transact With Each Other

Let me borrow another example, this time from Ivan on Tech. Say you’re in the vending machine business, and you’ve got contracts to supply machines for two stadiums. Right now, you need two vending machines, even if the stadiums are close to each other. On days when there are no events at a venue, you’re losing money.

Now imagine that you could instead have one vending machine, and it had the capability to simply hire a drone to move it between stadiums as needed, without your intervention. It would know where it’s needed and when, and could just order an autonomous vehicle to move it around. That’s the promise of the machine-to-machine economy.

Another example would be your self-driving car. It doesn’t have to sit in a parking lot all day while you’re at the office. Instead, it could offer itself as a vehicle for hire, ferrying people and goods around. It could also complete ancillary tasks such as refueling itself and taking itself to the mechanic for maintenance, paying with a digital coin like IOTA (which has no transaction fees).

All of this would not only make the world more efficient, but also reduce resource consumption. Rather than each family owning two cars, for instance, several families could share an on-demand self-driving car.

Bonus: As a World Currency

This would be similar to what the euro became for Europe. I don’t think that cryptocoins would necessarily replace national currencies in this regard, but they could remove a lot of the friction of international travel and payments that exists today. For instance, if businesses around the world accepted Bitcoin or Ether payments, it would be far easier to make transactions than the way it’s done today, where you have to buy the national currency of each country you visit.

Or, say you sold something to customers around the world (like art, for example). Rather than having your local stores set prices in local currencies, you could have one worldwide price in Bitcoin, without the hassle and cost of taking payments in many different currencies, which you’d then have to convert to your home currency.

July 2, 2019 Update:

I just wanted to include a great video from amazing YouTube-er Ivan on Tech explaining some of these concepts, plus others I hadn’t thought of:

Summing It Up

And that’s it, dear readers. I’m not really sold on the idea of paying for coffee and common stuff with Bitcoin, at least for the time being. It’s kind of like solving a problem that doesn’t exist, and maybe making it more complicated.

However, I do see huge promise in these 4 real-world applications for cryptocoins:

- As a store of value or medium of exchange in counties with currency controls or unstable currencies.

- For smart contracts.

- For the machine-to-machine economy.

- As a world currency, especially for international commerce.

Sounds awesome to me!

What do you think about the real-world use cases for digital coins?

That’s really helpful for understanding Miguel. It will be interesting to see what hurdles will develop and need to be overcome for wide spread use in the circumstances you indicate. If there is real economic benefit, these opportunities will certainly happen. Tom

Another possibility I’ve considered for cryptocurrency (maybe the smart contract portion) that I’ve considered is voting. This could be for real government elections, stock holder voting, or just for fun.