They say it’s hard to beat the market, and it is. But, it’s not impossible – even for us retail investors. I know because I did so over a one-year period (the time I’ve been picking my own stocks at a large scale, though I’ve been investing for many years).

Over a year, from September 10, 2019, to September 10, 2020, I beat the market handily, outperforming the S&P 500 by over 50%. And now I’m going to show you how I did it, by telling you all about my core investing principles.

But first, let’s see the evidence.

Disclaimer: This is all my personal opinion and not financial advice or any other kind of professional advice.

Proof I Beat the Market by Over 50% in a Year

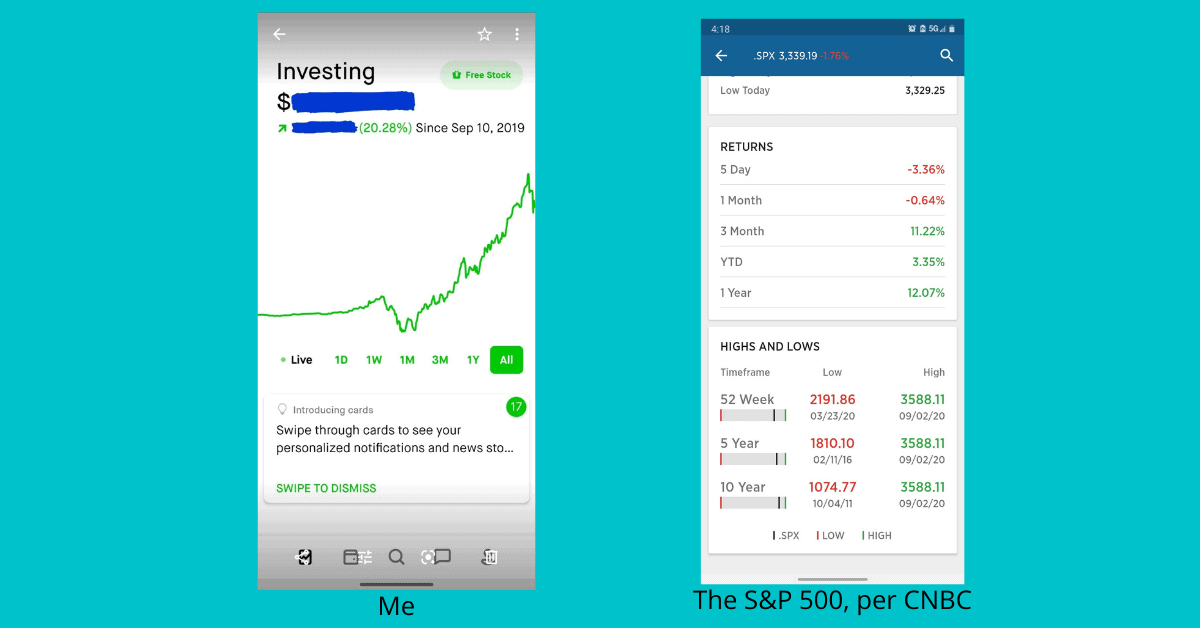

On September 10, 2020, my Robinhood brokerage account turned one year old. So, on that day I checked my performance and that of the S&P 500. It turns out I beat the S&P 500 by over 50%!

Here’s my Robinhood account performance from September 10, 2019 to the same date in 2020, compared with the S&P 500 Index (per CNBC):

That’s 20.28% (me) versus 12.08% (the S&P 500).

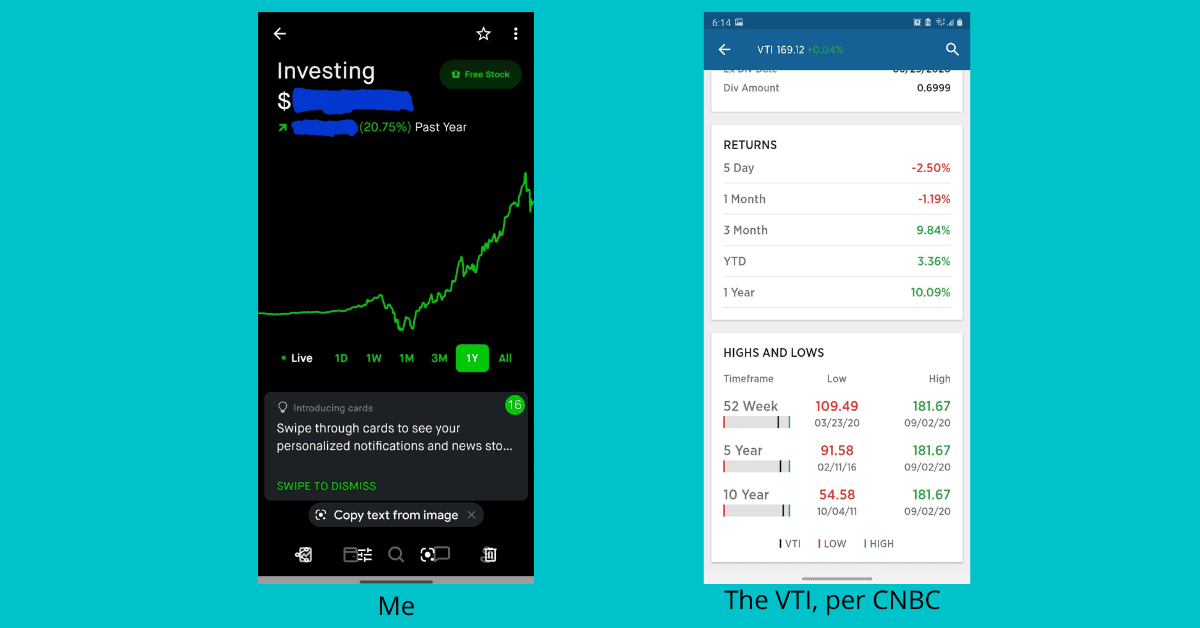

Here’s another comparison, from September 12: my account versus the Vanguard Total Stock Market ETF (VTI):

That’s 20.75% (me) versus 10.09% (VTI).

So, I beat the S&P 500 by over 50% and basically doubled the VTI’s performance! Not bad, eh?

Here’s how I did it. And don’t worry, I have no background in finance. I’m trained as a lawyer and studied philosophy and political science in college.

Now I’ll show you my simple investing principles.

My Investing Principles to Beat the Market

Invest in Value

Fundamentally, I’m a value investor. That means I buy stocks that I think are cheap or beaten up, but with excellent growth prospects. I have two main tools to do this.

A Low P/E Ratio

The first tool is the traditional low Price/Earnings ratio. I use this for more mature stocks in mature industries, such as banking or utilities. My criteria are that the P/E ratio be below 20 (preferably below 15 or even 10), and that the company be at least somewhat well-known and has been successfully in business for a while.

Some example buys here are Ally Bank and JP Morgan. Another great example would be ViacomCBS.

A Historically Low Price

P/E ratios are not as useful in some industries like tech. There, I pay more attention to a long-term price chart. I like good companies with historically low prices.

One recent purchase based on this criteria is FireEye, the cybersecurity company. Another would be Amneal Pharmaceuticals. These are somewhat risky buys, so they don’t make up a big part of my portfolio. But when I get them right, the growth can be explosive.

What About Growth Stocks?

Speaking of growth, I do buy growth stocks, but they are not my portfolio mainstays. Here, I tend to look for companies that I think are poised for lots of growth in the future for a specific reason.

For example, before the pandemic, I bought Zoom. Why? Because I saw a review saying it was the best videoconferencing platform, and I believed that this was an area poised for explosive growth in the future.

Another example would be Tesla, where I’m way up. I invested in Tesla because I believe self-driving cars are the inevitable future, and they have the best self-driving technology.

But again, the majority of your portfolio should be comprised of mature companies in future-proof industries. Buy these stocks when they exhibit low P/E ratios or other value characteristics.

Buy More During Pullbacks

Pullbacks are great opportunities to buy more shares at better prices. Remember, you want to “buy low and sell high”. So, beat the market by buying low!

To be a bit more graphic, and to quote Baron Rothschild, “buy when there is blood on the streets” is a good mantra.

Favor Dividend-Paying Companies

Dividends are a great source of income you can use to buy more stocks. But perhaps more importantly, they are a sign of a healthy and mature company. I do buy non-dividend-paying stocks from time to time, but have a big preference for dividend payers.

Buy stocks, rent cars

Look to the Future

Simple. Think of what the world will look like in the future and buy companies positioned to take us there. For this reason, I will not buy oil companies, for instance. I’m pretty convinced we’re at the beginning of the end of the age of oil, so I have no reason to own an oil company.

One stock I did recently buy is Blink Charging. Electric cars are the future, so they’ll need places to charge!

Buy What You Use

If you use a quality product, don’t be afraid to buy the stock! For example, I use and love Ally Bank, so I own quite a bit of Ally shares. I’ve also outsourced some graphic design for this website using Fiverr, so I bought that stock, too.

If you’re an early adopter of something and you’re convinced it’ll add value to the lives of many others in the future, buy the stock!

To Beat the Market, Buy and Hold

As an investor, I buy and hold. My intention is always to hold forever since I buy companies that I believe in and want to own a piece of into the future.

When do I sell? When I no longer believe in a company for any reason, or when I’ve held for a long time and it’s underperforming. I then use the sale proceeds to invest in more promising stocks.

Invest in the US and Other Developed Countries

I buy shares in companies from the US and other developed countries. Think Canada, Western Europe, Israel, Japan, Australia, South Korea, etc.

Why won’t I buy stocks from developing economies? Simply because regulation tends not to be as strong, and government not as clean. I want well-run companies from well-run countries with stability and transparency in government.

Don’t Buy Bonds or Options to Beat the Market

At least not in your discretionary stock portfolio. I have other portfolios comprised of ETFs where I do own bonds. However, here I’m talking about my portfolio where I choose each investment. There, I only buy stocks; bonds yield too little, and options are too risky.

Full disclosure: I also have some small positions in cryptocurrencies (mainly Ethereum). But the vast majority of my portfolio is individual stocks.

Diversify

I probably have over 100 positions in this portfolio. It’s necessary for diversification, and it’s also a natural byproduct of always looking for great stocks to buy. My biggest position comprises about 5% of my portfolio.

Sell Losers and Reinvest the Proceeds

Though I do advocate buying and holding, some of your buys will, over time, prove to be losers. In that case, go ahead and sell, but make sure to reinvest the proceeds. This has a double benefit.

- By selling at a loss you get a tax loss for your income tax return.

- You get to reinvest the proceeds in something better.

I’d suggest giving each stock at least 3-6 months to succeed, unless a very compelling reason to sell comes up. Just make sure you don’t get caught up in news cycles too much.

Relatedly, this is why you need to diversify. It’s very hard to be calm and unemotional about a stock if it takes up a big chunk of your portfolio!

Summing Up How I Beat the Market

I guess you can distill these principles into even fewer rules of thumb. In general, buy dividend-paying stocks that are future-proof, and buy them when they’re cheap. Sprinkle in some promising growth stocks. And for Pete’s sake, diversify!

Good luck!

What are your tips for beating the market?

Leave a Reply