It’s all in your head…well, a lot is, when it comes to your money management. You see, the mindsets you have and decisions you make will have huge effects on how rich you become over time and how comfortable and peaceful your financial life is.

And, it’s really much less complicated than it seems. By following just a few simple rules, you can be way ahead of the game. Let’s take a look at five of these.

5 Crucial Rules of Money Management Psychology

Note: this post may contain referral links.

Debt is a Necessary Evil

So take on as little debt as possible. Think about it: every time you buy something with borrowed money, you’re paying not just what it costs, but also interest. It stinks to high heaven, if you think about it.

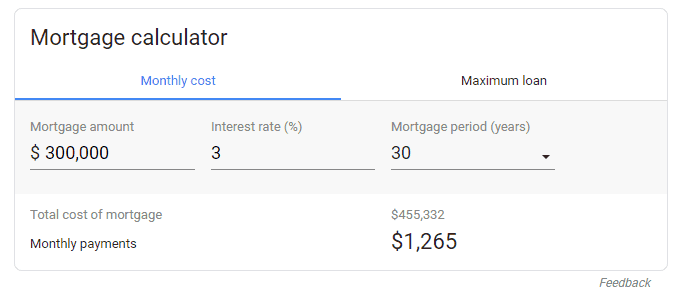

Just take a look at a simple mortgage calculator on Google: if you borrow $300,000 at even a low 3% rate, you’ll have paid over $155,000 in interest when it’s all over! That’s over 50% of what you borrowed!

Ouch!

That’s why I think the proper money management mindset as to debt is that it’s a necessary evil. So, minimize it as much as possible. We all probably need a mortgage and a car loan at some point (and maybe also student loans), but we should not take on much unnecessary debt beyond that.

Be Eager to Put Your Money in Savings and Investments

Have you ever heard of an acquired taste? You know, how you can learn to love something that initially tastes kinda bad (like wine)?

Apply the same thing to money: acquire a taste for putting it in savings and investment vehicles (instead of spending it). You can start with high-yield savings accounts at banks like Ally and long-term investments in broad index funds like Vanguard Total Stock Market ETF (VTI), which you can buy on most any broker for zero commission (I like Robinhood because it’s super user-friendly).

Here’s what’s so yummy about this acquired money management taste: cash you spend is pretty much gone forever, into someone else’s pocket; cash you save is yours forever and will throw off extra cash (interest, dividends) for you, which you don’t have to work for!

Take a Liking to Reinvesting Dividends and Interest

The beautiful thing about reinvesting dividends and interest is that those dividends and interest will themselves earn more dividends and interest.

Say you’ve done well and have $100,000 in an index fund yielding 3% yearly dividends. So in a year you’ve made $3,000. If you reinvest them, next year you’ll make (not considering taxes) $3,090. That’s $90 more that you did not have to work for.

It may not look like much, but it compounds over time. In fact, it’s over $30,000 in a decade, and that doesn’t even take into account the fact that stock prices consistently rise over the long run.

Hate Selling Stocks

For pretty much every individual investor, buy-and-hold investing is best. If you don’t believe me, ask Warren Buffett. So, invest as much as you can, as often as you can, and don’t sell often.

When do I sell? I almost never sell an index fund, and I normally sell an individual stock when I lose some faith in the company. For example, as a techie, I own a bit of Qualcomm, which makes the main chips found in most Andriod phones. When strong rumors started that Google might start making its own chips, I sold off some of my Qualcomm holdings (at a profit, if I remember correctly).

Never Pay Full Price

Ok, ok, ok. Sometimes you can’t avoid it. But, you usually can. Prices are not static. They change all the time, and you can avoid paying full price (or “fool’s price” as I like to call it) with strategies like:

- choose an alternate brand (like a store brand);

- wait for a sale;

- negotiate (on cars, homes, and other negotiable items);

- buy used.

I say reduce what you buy (and focus on experiences rather than things), invest all you can, and don’t pay full price when you do spend.

Not paying full price for that…

Summing Up the Money Management Rules

And that’s it! By following these five rules, you’ll have a big head start over most folks. You can be comfortable, and even wealthy. And yeah, not everything is under your control, and the unexpected happens – just look at the coronavirus. But why not make the most of the things that you can control?

So remember:

- Debt is a necessary evil to be minimized and avoided.

- Acquire a taste for saving and investing – your money will make you money.

- Reinvest dividends and interest.

- Try not to sell investments.

- Don’t pay full price!

Cheers!

What are your best money management rules?

Great advice Miguel. I’m a big fan of dividend reinvestment. I used to do it automatically for my holdings. But now I let the dividends accumulate and reinvest lump sum. Either option is solid from my perspective as long as the investor does reinvest while in an asset accumulation phase. Tom