Well, well, well. It seems Mr. Stock Market Volatility has reared his ugly head again. My advice for volatile markets? That’s right. Don’t panic.

We have been pretty spoiled the last decade in the markets, haven’t we? I mean, it’s pretty much been nothing but up, up, up since March, 2009 when the markets began to recover. Here’s a news flash – this is not normal!

As I’m composing this post on Wednesday afternoon, October 10, 2018 at 4:20 pm, the DJIA closed down -831.83 (-3.15%), the S & P 500 -94.66 (-3.29%), and the NASDAQ -315.97 (-4.08%). As bad as this feels, it’s not unusual.

In the last ten years, and throughout the history of the markets, we’ve had lots of down days. I’ll show you some of those years, review the history of bear and bull markets, and give you my best advice for what to do.

To review – Don’t Panic!

Note: This is a guest post from Fred, the amazing writer behind Money With A Purpose. I (Miguel Suro) made some minor formatting edits on February 22, 2020.

How to React in the Face of Stock Market Volatility

Stock Market Volatility is Part of the Package

I’ve recently written about being ready emotionally for a market meltdown. It’s one thing to intellectually understand the theory of markets, how they work, and the best way to invest. It’s another thing entirely to live through a period like the last financial crisis in late 2008 and early 2009.

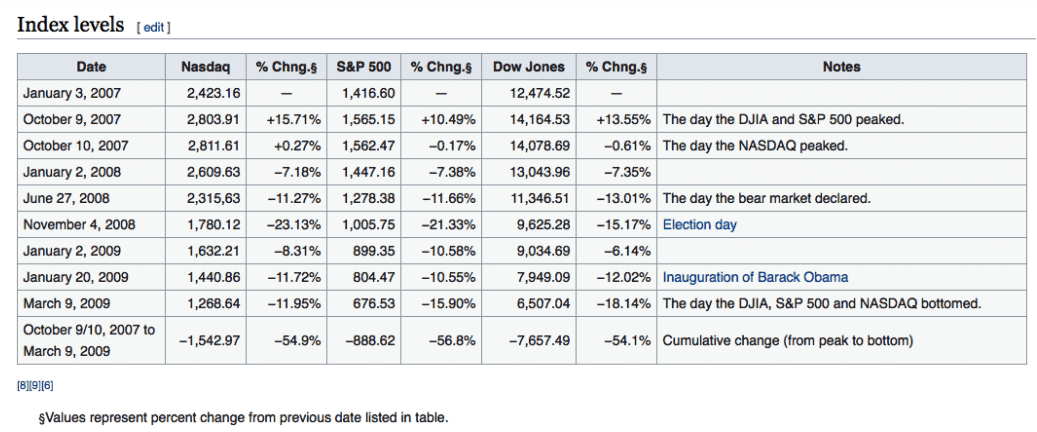

The crisis started long before that. It became painfully apparent when the markets went haywire. Do you remember those days? I know I do. Panic was everywhere. Take a look at this chart, which shows the day-to-day market activity during part of the period:

Credit: Wikipedia

Look at some of the days’ changes:

S & P 500: -10.58%, -7.38%, -11.66%, -21.33%

DJIA: -15.17%, -7.35%, -13.01%, -18.14%

I don’t think we need to go any further, do we? You’re feeling a lot better now looking at the recent 3% drop, aren’t you?

Here’s the point. Stock market volatility is normal. In any given year, drops of 10% or more during the course of the year are common. In most years, they are short-lived. In others, they are not. Short-term swings in the market are a normal part of the process.

If you can’t handle the fluctuations, the stock market may not be a good place for you to invest. You have to understand that ups and downs are part of it.

With that in mind, it might be a good time to remind you that stocks are not short-term investments. Day-traders notwithstanding, investing in the stock market is to build wealth over time. The day-to-day, month-to-month, quarter-to-quarter, and even year-to-year returns have little meaning for your long-term results.

Don’t believe me? Let me illustrate it another way.

Bull and Bear Markets

Bull markets occur when the economy is growing, unemployment is low, companies are hiring workers, wages are increasing, and families are spending money. Optimism is high. In theory, that confidence encourages people to invest in the markets. That sends stock prices up and the markets up. That’s the bull market. Pretty simple, right?

Bear markets, on the other hand, occur when those things that encourage investing move in a negative direction, causing people to sell stocks and buy safer investments like CDs, Government bonds and Treasury securities. Conventional wisdom says a drop in the markets of 20% or more indicates a bear market.

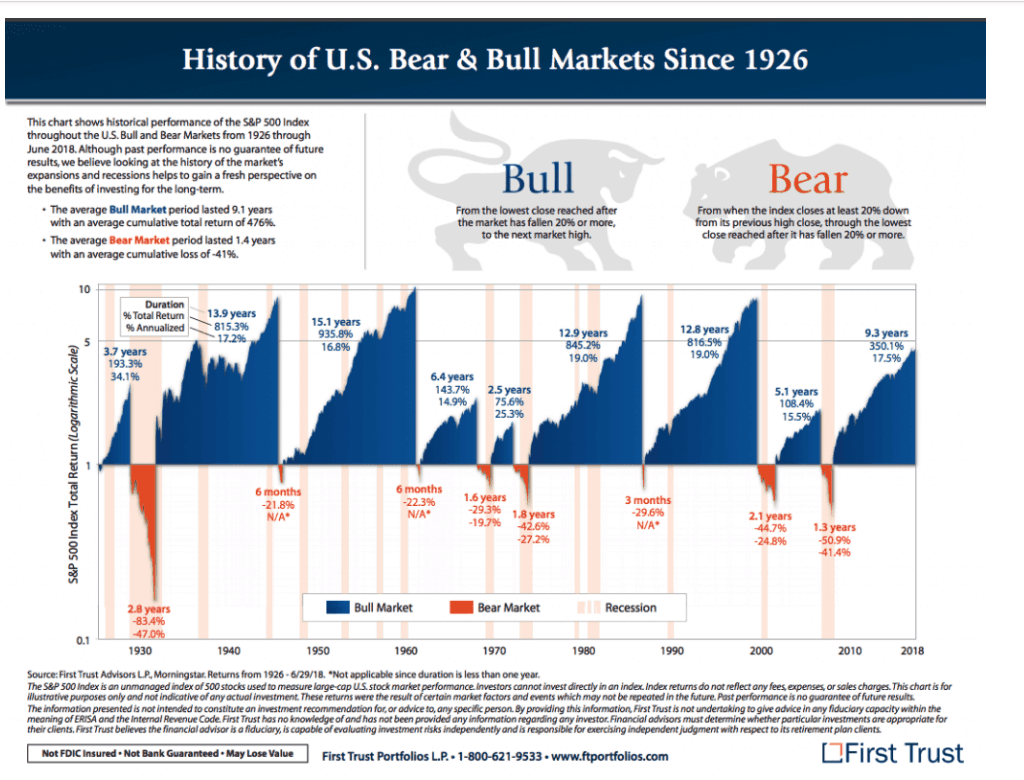

Bull markets historically last a lot longer than bear markets. The average bear market, depending on the source cited, seems to be in the neighborhood of 18 months or so. On average, bear markets occur every three years or so. That makes the current decade-long run in stocks even more remarkable.

The chart below shows both bull and bear market periods.

Credit: First Trust

One thing that’s crystal clear from the chart is how many more bull markets there are than bear. The other thing is how much longer they usually last.

We also need to keep in mind that bear markets, though uncomfortable, are part of investing in the stock market. And they are unpredictable. How often in the last few years have you heard we’re about to have one? For those around in the nineties, we heard it for close to five years. It’s eerily similar to the ten-year bull market we’re currently enjoying.

Make no mistake. A bear market is coming at some point.

Is This the Beginning?

That’s hard to tell. The accepted definition of a bear market is a drop of -20%. We’re a long way from that at this writing. However, as you can see from the charts above, we can get there in a hurry.

Keep in mind, though, that the markets are efficient (I realize that’s a topic of great debate), but they are also unpredictable. Though the conditions cited about bull and bear markets above are usually present, events outside of those can trigger massive sell-offs.

The efficient market hypothesis says that all of the information available on a company is already baked into its stock price. Collectively, the market knows better than individuals. So, markets are never over or underpriced. Current prices represent the collective wisdom of the markets.

What that means, then, is that bull and bear markets don’t change the efficiency of the markets themselves. Those ups and downs reflect the collective wisdom of all participants.

I realize you didn’t ask for theory but want to know when the heck the bear will rear its ugly head. The efficient market theory says that no one knows. And that’s the point.

How to Prepare for Stock Market Volatility

I’ve outlined some of these in a previous article. Let me summarize them here.

Know Your Why

Understand why you’re investing. What’s the purpose for the money invested. That’s a foundational principle that’s often neglected. Knowing your why is another way to look at it. Taking a long-term view with your eye on the goal helps you stay invested.

Know Your Risk

Understand your willingness, ability, and need to take investment risk. Too many investors have too much risk in the portfolios. If that’s the case, when a bear market comes, it will make it harder to stay invested. Jumping in and out of the market is no way to be successful. Your portfolio needs to match your ability to tolerate downside risk.

Have Some Portfolio Insurance

I’m not talking about some fancy derivative investment Wall Street is selling (see last financial crisis). I’m talking about keeping it very simple. If your portfolio is 100% in stocks, consider adding some high quality, short to intermediate-term bonds. My preference is Treasury securities. Some will argue that in this low-interest rate period it makes no sense to hold bonds of any kind. They offer little to no return. True enough. That’s not why bonds should be part of the portfolio.

When stocks go down, especially when those drops are in the form of severe stock market volatility, investors quickly sell their stocks and flee to safe investments. What are those? Treasury securities and other government and high-quality bonds. Supply and demand say that when demand is high, prices follow. People flock to the safe haven of these bonds, increasing their prices – and thus your potential return. They act as an offset to falling stock prices.

I see too many younger investors holding all stock portfolios with no regard for the potential risk. Remember, if your portfolio drops 50%, you need a 100% return to get back to even. At a 7% average annual return, that takes over ten years to recover (assuming no reinvestment). I don’t think those who’ve never experienced a serious bear market understand that risk.

Stress-test Your Portfolio

Test your current investments to see how they would respond in a worst-case scenario, including severe stock market volatility. The last financial crisis is a pretty darned good measuring stick. Most custodians (Fidelity, TD Ameritrade, Schwab, etc.) or mutual fund companies can help you do this.

When you do this test, don’t just look at the percentages. Look at the dollar values. If you have a $500,000 portfolio that drops 50%, you now have a $250,000 portfolio. How would you feel if that happened? Could you hang on? Would you be inclined to sell? The answers to those questions will tell you if you have too much risk in your portfolio.

Rebalance

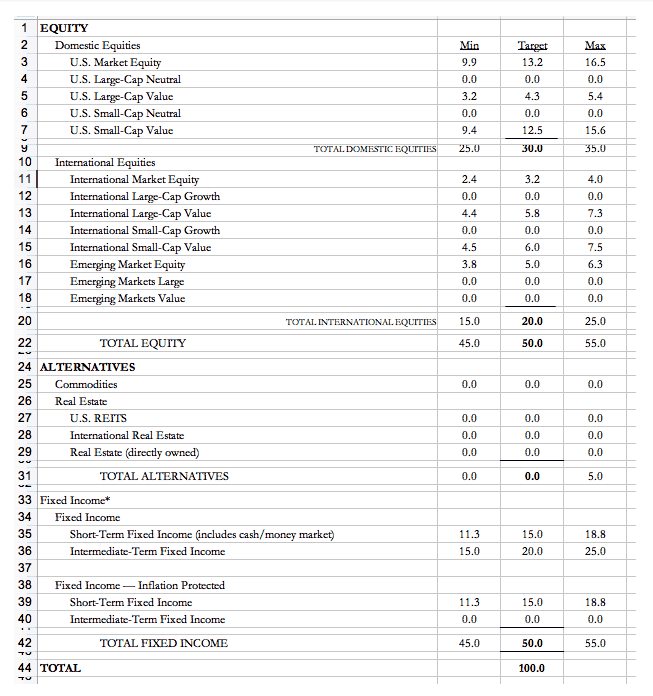

Rebalancing is like the ultimate free lunch. It simply means selling investments that have gone above your target allocations (you have those, right?) and buy those that have dropped below. In the example of portfolio insurance, in a bear market, that means selling bonds that have increased and buying back stocks that dropped. For my client portfolios, we set ranges for each asset class. That can be from 20% to -25%.

Let’s say your target for U.S. stocks is 30%. A 20% limit means that when U.S. stocks go above 36% or below 24%, you’d consider buying or selling. You’d do the same for bonds. Below is a sample of how that might look.

I’m guessing this chart is far more granular than your portfolio. Use this as a sample and insert the asset classes and target percentages you use. Check with your custodian or mutual fund company to see what they provide. Having a rebalancing strategy in place sets up a process to buy low and sell high incrementally.

Final Thoughts on Stock Market Volatility

I hope you find the information offered helpful. I can’t tell you whether we’re entering a bear market or not. Time will tell. I do know that at some point, we will have one. It’s my personal opinion (take that for what it’s worth) that the next bear market will be a doozy.

Bear markets get triggered by events outside economics, corporate earnings, and interest rates. Geopolitical events can be a trigger. There is much economic uncertainty. The recent selloff came from fear about the trade war, specifically related to China. Comments by a respected analyst or economist can be a trigger as well.

Here is the point. These are all things outside of our control. We can speculate, argue, engage in hand-wringing and enthusiastically yell our positions at each other. It still doesn’t change the fact that we can’t control it.

What we can control are the things I’ve outlined above. Know your why. Check your allocation. Make sure you have prepared for the bear, whenever it comes. Run a stress test. Set up your rebalancing system.

Taking these steps will allow you to sit back and watch things unfold, knowing you’re prepared and ready to take advantage.

Sit back, relax, and enjoy your favorite adult beverage (in moderation, of course).

How would you react to stock market volatility?

Last Updated: February 22, 2020 by Miguel A. Suro

I’ve been mostly focused on adult beverages this year while the market has continued to go up. My saying has been “I’ll let the market and my dividend paying companies do the work”. It’s been about as passive as it gets. The problem with volatility for me. Or I should say the market going down (cause no one worry’s about volatile up days) is I may have to sober up and get back to work putting my excess cash from dividends into good companies and their stocks. Give me a few more days like Wednesday and Thursday and I will have to switch to water and get busy. Timely post and good advice here. Thanks, Tom

I’ve been waiting for this!! I have a cash stash to buy on the dips!! I love volatility

I used to panic and lose sleep (and money). Now, I ride the wave and reanalyze my holdings. My wife, on the other hand, panics a little but I try and reassure her.